Really don't be afraid to ask for money support from family and friends. They can be an awesome source of help in instances of issues. When they cannot lend you money, they offer help in other techniques to minimize your monetary load.

Prior to deciding to borrow, take into account the solutions to a payday loan. Whenever you’ve fatigued People choices and consider a payday loan is your very best guess, adhere to these ways to make sure you get a very good offer.

Not typically. Payday loans Have got a high APR, however it isn’t on account of a high fascination level. APR is really an expression in the loan’s whole Expense like a share, which includes both of those desire and fees.

Tennessee: The Point out of Tennessee demands a least principal reduction. In order to adjust to the bare minimum point out-essential principal reduction, Fast Funds requires that least payments include a principal reduction of two% or $2.

Consequently each individual thirty times from the main working day you are taking a payday loan, you will get to pay a every month fee around the loan harmony. In the event you take the loan for under 30 times, you shell out the month to month fee when, however, if it extends beyond thirty times – even by per day –

Particularly, we glance at your month-to-month money, work background, and other debts when building our approval choice. This suggests you could continue to qualify for an unexpected emergency own loan with poor or truthful credit.

At Examine Into Money, we enable it to be rapid and easy to have the cash you require. Regardless of whether applying for just a Payday Loan on the net or checking out one of our retail spots nearby, we're happy to provide problem-free borrowing selections.

If you don't have an affordable repayment strategy immediately after using a loan, you will be in difficulties in the event the loan is because of. Hence, you want a flexible lender who features you distinct possibilities to satisfy your loan repayment disorders.

Most installment loans may have a fixed regular monthly volume you happen to be necessary to pay back, and the quantity won't alter through your repayment period of time. The payments' predictability may help you spending plan for your month-to-month costs and stay away from credit card debt and further expenses. Samples of installment loans are house loan loans, car loans, and college student loans.

And in the event the loans are rolled-more than outside of the initial repayment date, it incurs far more fees and curiosity. That is definitely why you have to make use of the payday loan calculator right before taking out any of this sort of loans.

Overdraft costs might cause your account to generally be overdrawn by an total that is larger than your overdraft protection. A $15 charge may implement to each suitable obtain transaction that brings your account detrimental. Stability must be introduced to a minimum of $0 in just 24 hrs of authorization of the first transaction that overdraws your account to stop a payment.

One example is, if you have to borrow a bigger loan quantity with extended regular monthly payments, you may perhaps take into account an installment loan. In the event you’re unsure how much you may need but would want to have some money to drop back again on, a private line of credit history is usually a good choice.

To repay your loan, you are going to both will need to deliver your lender with access to your banking account for an automated transfer click here or indication a put up-dated check.

You may also be asked to supply documentation as proof of identification. Acceptance is contingent on correctly passing this mandatory identification confirmation.

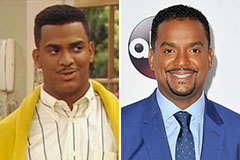

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!